Each project and asset is legally independent and has its own managers.

Shadow Carbon Pricing

Aligned with the recommendation of the Paris Agreement to establish Carbon Prices, we have created a methodology known as “Shadow Carbon Pricing”.

What is Shadow Carbon Pricing?

Shadow Carbon Pricing is a methodology that quantifies risks and opportunities for new investments in CO2 emissions, created based on the recommendations of the Paris Agreement to establish carbon prices.

To do so, Shadow Carbon Pricing takes into account different factors such as the economic cost of carbon emissions, the taxes applied to fossil fuels, and changes in user usage, oriented towards new habits and demands by society.

The working methodology goes beyond a constant measurement of CO2 emissions associated with each project; the idea is to account for and translate into a monetary value the environmental and social perception cost of these emissions in a growing total (2020, 2030, 2040, 2050). In this way, the risks associated with climate change are faithfully reflected, allowing us to identify short-, medium- and long-term risks.

One of the key objectives of this way of working is to maintain the profitability of the businesses in which we operate as they migrate to low-carbon models. It is also an exercise in transparency and serves as a benchmark for other industries to follow. This has led us to participate as partners of the World Bank in the drafting of reports such as the “Carbon Pricing Leadership report”.

Average carbon price estimates

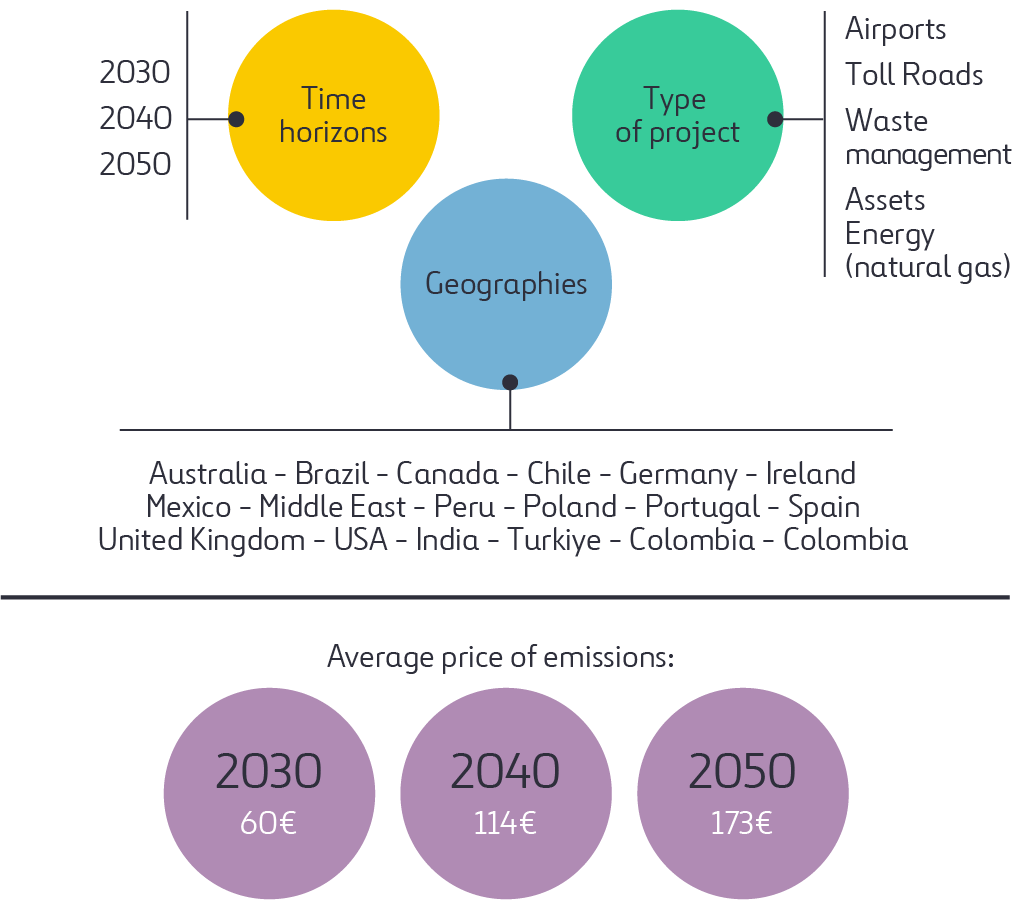

Our methodology distinguishes between time horizons, geographies and project types. By doing so, an escalating cost is assigned to provide investors with the business analysis they need, providing an estimate closer to reality. This calculation, together with the sustainability indices among which we are present such as DJSI and FTSE4Good, are metrics to be taken into account which allow us to improve our sustainability policies and projects.

In summary, our respective decade horizons estimate an average carbon price of 60 euros in 2030, 114 euros in 2040 and 173 euros in 2050. These increases are related both to decarbonization to avoid abrupt climate change and to end-users’ perception of the company’s ethical policies.